"The pullback after hours is an overreaction to geopolitical events outside of the company's control, not a weakening demand environment," said Logan Purk, analyst at Edward Jones, noting the tumble in Nvidia's share price. He expected Nvidia to face more downturns going forward. Kinngai Chan, analyst at Summit Insights Group, said almost every tech company that has missed on outlook has blamed the Russia-Ukraine conflict and China's COVID lockdowns. Kress told analysts on the earnings call that China's COVID lockdowns, in addition to affecting logistics, were hitting consumer spending.ĭan Morgan, senior portfolio manager at Synovus Trust, said it was puzzling that a company that navigated the supply hurdles so well up to now suddenly hit a bump in the road.

Chief Financial Officer Colette Kress said the $500 million figure included about $400 million lost in gaming sales in China and Russia, and another $100 million lost in data center sales in Russia.

Analysts on average expected $8.45 billion, according to IBES data from Refinitiv.The lower revenue forecast included an estimated reduction of about $500 million relating to Russia and the COVID lockdowns in China.

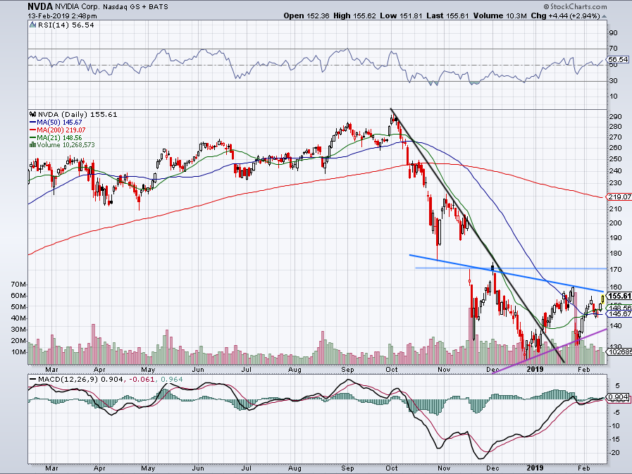

#Nvda earnings disappoint plus

Nvidia forecast second-quarter revenue of $8.10 billion, plus or minus 2 per cent. economy, as consumers weigh purchases of items such as laptops and video game consoles. Federal Reserve.Ĭoncerns over inflation are spreading through the U.S. The shares are down about 40 per cent so far this year in tandem with a wider selloff in growth stocks over concerns of aggressive interest rate increases by the U.S. Nvidia shares fell 6.7 per cent in extended trading, even though the company's first-quarter revenues and earnings topped analyst estimates. Nvidia is also taking a hit from Russia and sees "slower sell-through" in Europe, he said. Based on the softer market demand, Nvidia has chosen to reduce what it sells into the China market, he said. "Overall the gaming market is slowing," Huang said. (SOXX), which tracks the performance of the ICE Semiconductor Index.:Chip designer Nvidia Corp forecast its sales of video game chips would decline in the current quarter, and startled some analysts by laying out new supply-chain issues resulting from China's COVID-19 lockdowns.Ĭhief Executive Jensen Huang told Reuters that Nvidia's gaming business revenue will post a percentage drop in the mid-teens for the current quarter compared with the previous quarter. Nvidia’s stock had declined by 41% this year as of Wednesday’s close, vs. Some analysts are worried that demand for Nvidia’s graphics cards might stay weak due to its exposure to crypto-mining, elevated pricing for its high-end cards, and the negative effects from a deteriorating global economy.

#Nvda earnings disappoint software

She also expressed confidence the partnerships they have with game publishers and Nvidia’s more advanced software features would beat the competition. ), Kress said their cards have a stronger brand with gamers and dominate the rankings for the most-used cards on gaming services. Regarding the potential for stronger competition this upcoming cycle from In a phone interview after the call, Chief Financial Officer Colette Kress said Nvidia’s products using their new chip architecture will be “coming soon.” When asked if the pricing structure for the current generation Ampere cards is sustainable for the next one, she said they will look at market conditions at launch to set pricing.

Nvidia was “unable to quantify” the extent to which reduced cryptocurrency mining drove the decline in gaming card sales.

Both prices and the number of units sold deteriorated during the quarter, an executive said. On a conference call to discuss the results, management said Nvidia saw a “sudden slowdown” in demand. At the time it blamed weaker-than-expected gaming segment sales. “We are navigating our supply chain transitions in a challenging macro environment and we will get through this,” said Jensen Huang, founder and CEO of Nvidia, in the release.Įarlier this month, Nvidia preannounced disappointing results for its fiscal second quarter. For the current quarter, Nvidia said revenue will be in a range with a midpoint of $5.9 billion, which was way below the consensus call of $6.9 billion. ) had issued earlier and analysts’ recently reduced expectations. Revenue came in at $6.7 billion, which was in line with both a negative preannouncement The semiconductor company reported adjusted earnings per share of 51 cents for the July quarter, compared with the consensus estimate of 50 cents among analysts tracked by

0 kommentar(er)

0 kommentar(er)